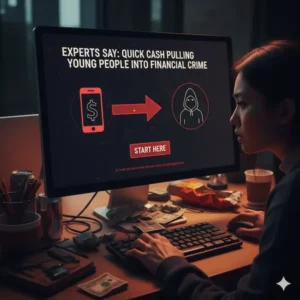

Experts Say: Quick Cash Pulling Young People Into Financial Crime

“Professionals are alerting youngsters not get into this ‘Quick Cash’ Scheme that is turning things too dirty.”

Teens who browse social media are increasingly being lured into a shadow of Financial Crime economy that offers quick money but leaves long-term financial, legal, and psychological scars, often before they fully comprehend the hazards.

An Opportunity-Seeming Crime

The ads on Instagram are purposefully unremarkable. A picture of money in well-groomed hands. “Do you want to make quick money today?” is the caption. Such messages don’t always seem illegal to young people who are used to influencer culture and “side hustles.”

However, these messages are frequently the first step in money muling, a type of money laundering in which criminals use middlemen to transfer stolen or fraudulent money via their bank accounts, according to law enforcement officials, fraud experts, and children’s charities. The organizers stay anonymous while the middleman gets paid a commission.

According to official data, the scale is expanding quickly. Based on data from 37 financial institutions, the Financial Conduct Authority estimated that over 207,000 personal accounts were used for money muling in 2024, a 22% increase from the previous year. Ages 22 to 29 made up the largest percentage of participants (33%).

Experts claim that a younger, less visible population is responsible for those figures. According to Cifas, a fraud prevention service, at least 19% of money mules are under the age of 21. Experts contend that since cases involving children under 16 are not routinely documented, the true number is probably greater.

Grooming, Not Just Fraud

Recruitment strategies that more closely resemble grooming than conventional fraud are described by children’s organizations.

James Simmonds-Read, National Programme Manager, The Children’s Society

| On social media and online gaming platforms, young people frequently come across phony employment advertisements. After establishing confidence by posing as friends with similar interests, recruiters ask for assistance transferring funds, frequently characterizing the process as “risk-free.”

“Since the data that is currently accessible is only ‘the tip of the iceberg,’ it is extremely difficult to obtain an accurate picture of the scope of this issue.”

Unexpected new gifts or clothing, a strong emphasis on earning money online, secrecy regarding phones and applications, strange financial activity, or pressure to register a bank account are some warning indicators. However, these cues could go unnoticed by parents and educators, especially if the action is presented as employment rather than criminal activity.

Before the promise of easy money has a chance to solidify into a habit, preventative education should start in elementary school. |

Simmonds-Read has been collaborating with the Home Office, which has promised to take action against money-muling and child exploitation, including reevaluating the terminology used. He contends that by “comparing them to animals,” the phrase “money mule” runs the risk of dehumanizing victims.

“I Needed Quick Cash”

The repercussions were swift for Derai. He was excited to start a modeling career at the age of 19 and earn enough money to relocate from Manchester to London. He was quickly put in touch with a recruiter after replying to an Instagram post offering quick income. He revealed his identity and bank account information. The money came in a matter of days.

The machine swallowed his card as he attempted to withdraw it. His account was shut off. His record was marked with a Cifas tag for six years, making it practically difficult for him to create another bank account. He relied on his mother’s account for employment, but he was concerned about the impression it made.

Derai

| “It was a little depressing. “I felt a little down and annoyed that I had completed the task.”

“I’ve developed and learned. “Now, I wouldn’t do that.” |

Derai convinced the financial ombudsman to take down the marker after ten months. But the recruitment messages continued.

Fraud Specialists

| Many young individuals are unaware of the possible consequences. Some are prosecuted and sentenced to up to 14 years in prison; others are “debanked,” meaning they are unable to access fundamental financial services like loans and mortgages. |

An Exposed Generation

Money muling is “probably one of the biggest threats to young people now,” according to Nicola Harding, a fraud expert at the University of Lancaster.

Nicola Harding, Fraud Expert, University of Lancaster

| It has expanded quickly over the last five years due to social media and a culture full of “get rich quick” stories.

Young people have grown up witnessing internet scams that promise easy money. The proposal does not always appear to be clearly unlawful when criminals approach it.

“They would never do it if you told them, “That woman has a bag of cash, knock her over.” |

Jeremy Asher, Financial Fraud Lawyer, Founder of the Financial Fraud Awareness Campaign

| During school breaks, when cases tend to increase, parents should be especially watchful. |

He claims to have witnessed “an alarming number” of young people being dragged in, frequently without fully comprehending what they are being asked to do.

According to senior policing officials, online scams now account for over 40% of documented crime as digital technologies continue to surpass regulations. Experts contend that teaching is just as much of an issue as enforcement.

About The Author

Suraj Koli is a content specialist in technical writing about cybersecurity & information security. He has written many amazing articles related to cybersecurity concepts, with the latest trends in cyber awareness and ethical hacking. Find out more about “Him.”

Read More:

“ClickFix” Trap: Qilin Ransomware Infection Caused by False Human Verification