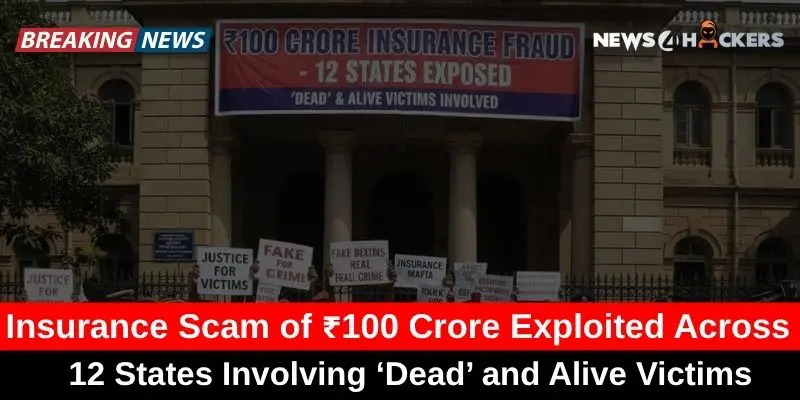

Insurance Scam of ₹100 Crore Exploited Across 12 States Involving ‘Dead’ and Alive Victims

“There is a big insurance scam running around, recently made over ₹100 Crore and exploited around 12 states.”

The appalling abuse of vulnerable groups, such as the impoverished, the seriously ill, and even the dead, has been made public by the revelation of a vast insurance fraud network that spans 12 Indian states.

Police investigations have so far resulted in 68 arrests, and they are still working to uncover the entire scope of the network that has siphoned off over ₹100 crore in bogus insurance claims. Trilok Kumar, a Delhi man who was shockingly pronounced dead twice in six months, once on June 19, 2024, from cancer, and again on December 27, 2024, from a heart attack, is the case that exposed the plan.

Official death certificates issued by the Delhi Municipal Corporation were utilized in both cases to obtain ₹20 lakh in insurance claims. Even while Kumar’s case is exceptional, it only makes up a small portion of the wider swindle that defrauded many others.

Vehicle Interception Shows Fraud Trail

On January 17, 2025, Sambhal police stopped a suspicious Scorpio during a normal patrol, which sparked the investigation. Officers discovered over 30,000 insurance-related documents, including forged medical certificates, 19 debit cards, and ₹11.45 lakh in cash inside.

Omkareshwar Nath and Amit, the suspects, were found to be former employees of an insurance business who were heavily involved in the fraud. The network preyed on the impoverished and the very sick, exploiting their vulnerabilities to obtain expensive insurance plans, police found.

Claims were processed quickly after many victims were certified deceased on paper while still alive, giving scammers access to substantial sums of money.

PMJJBY Exploitation and Aadhaar Manipulation

In order to make older people eligible for coverage, scammers also modified ages under the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY). For instance, Pancham Singh, who was born in 1955, was mistakenly identified as having been born in 1976 by means of excellent iris scans that were uploaded to the Aadhaar system.

By taking advantage of systemic flaws, scammers were able to obtain policies and obtain payouts shortly after the victim’s passing. By granting access to medical records and death certificates and forcing signatures, local ASHA employees, village chiefs, and hospital personnel were instrumental in enabling the fraud.

Accounts were opened, rewards were transferred, and commissions of up to 20% were collected by complicit bank staff.

Murders and Fraudulent Deaths Passed Off as Accidents

In a few situations, intentional killings were pretended to be accidents. Dariyab Jatav, a disabled citizen of Badayun, was pronounced dead following an alleged traffic collision. According to post-mortem reports, injuries were not consistent with an accident.

His brother planned the murder to receive ₹58 lakh in insurance payouts, investigators discovered later. Poor and seriously ill people who were tricked into signing insurance under false pretenses were among the other victims.

Some people were informed that their insurance would pay for medical care, but in practice, their data was used to create false claims.

Systemic Abuse in 12 States

Gujarat, Uttar Pradesh, Assam, and other states were home to the scam network, which mostly targeted Hindi-speaking areas where manipulation was made easier by language obstacles. There were several layers involved in the operation:

- Policy flaws are being exploited by investigators and insurance salespeople.

- Targets are being identified, and record collecting is being facilitated by ASHA employees and local leaders.

- Falsified medical records are being produced by hospital employees.

- Employees of banks take commissions, transfer payouts, and open accounts.

The Human Price of Deception

Many victims had no idea that claims were being made or that policies had been taken out in their names. Families were intimidated or misinformed; they were occasionally promised that the insurance money would pay for therapy, but in practice, the money went straight to scammers.

Investigators emphasize that this scam revealed obvious flaws in the insurance system, such as the ease with which death certificates could be manipulated and the possibility of identity fraud based on Aadhaar.

Authorities are trying to stop similar schemes from happening again and secure any illegal transactions that exceed ₹100 crore.

An Important Note for Policyholders

The safety of insurance systems is seriously called into question by this controversy, which also emphasizes the necessity of more stringent control and verification procedures. The case serves as a clear warning to both policyholders and regulators that insurance, which is meant to be a safety net, may be abused for enormous financial benefit if control is lacking.

This is because fraudulent networks are taking advantage of holes in documentation, Aadhaar identification, and bank procedures.

About The Author

Suraj Koli is a content specialist in technical writing about cybersecurity & information security. He has written many amazing articles related to cybersecurity concepts, with the latest trends in cyber awareness and ethical hacking. Find out more about “Him.”

Read More:

Infected WordPress Sites Spreading Malware, while Hackers Exploit Blockchain Smart Contracts