Important Tax Scam Alert as Criminals Get Ready to Take Advantage of the EOFY

Australians are advised to exercise caution over the coming months as the possibility of scams is on the rise as the financial year comes to a conclusion.

In the upcoming months, Australians face a greater chance of becoming the next victim of cyber intruders as they attempt to steal money from victims via end-of-financial-year or tax-related frauds.

Based on a recent study from Commonwealth Bank (CBA), one in four Australians (24%) has fallen victim to fraud involving EOFY or tax issues.

Fraudsters don’t always keep waiting until June 30, when individuals start filing taxes in order to discover their targets, according to the bank’s fraud experts.

Only 5% of respondents reported being victims of EOFY or tax-related scams during tax season, indicating that individuals are being targeted in advance with phony advertisements and schemes intended to defraud them of their money.

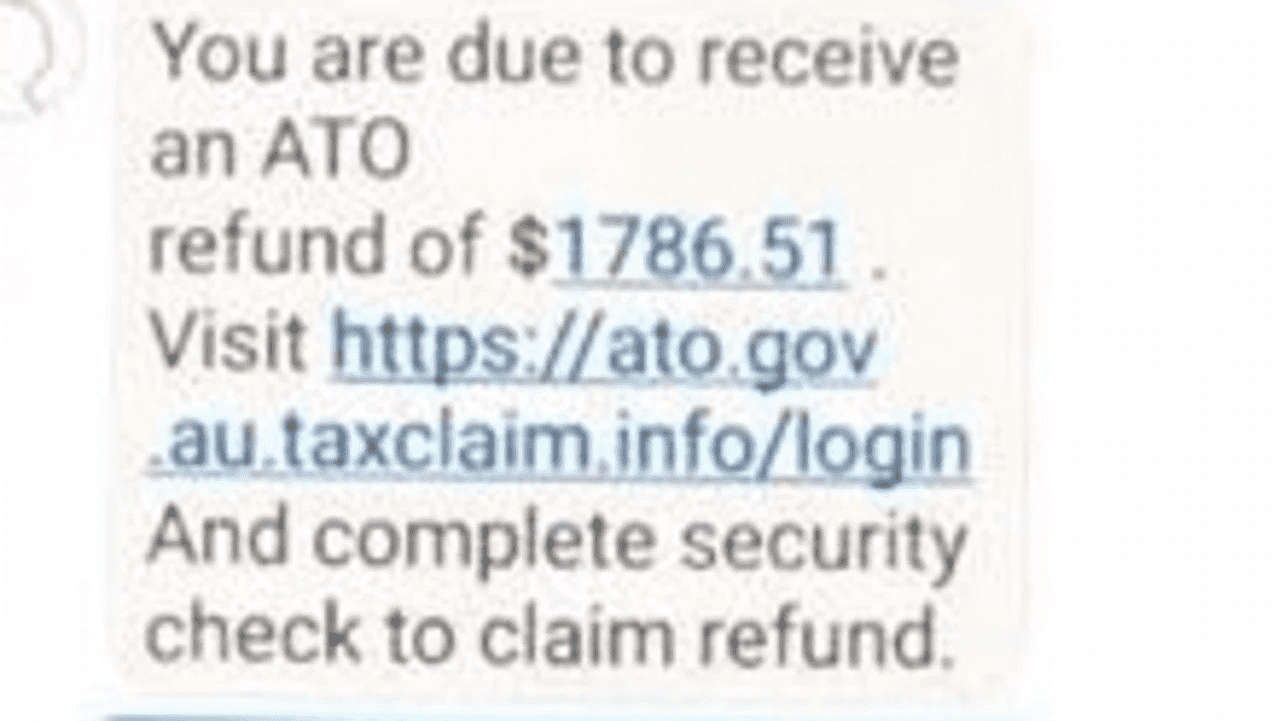

Users are cautioned against refund scams by the Australian Competition and Consumer Commission’s Scamwatch organization. In these schemes, cybercriminals persuade victims that they are due a refund from the Australian Taxation Office (ATO), frequently as a result of overpayment or left unclaimed taxes.

These con artists demand a minimal upfront payment from their victims to cover “administration fees” before allowing them the ability to access the money that is “owed” to them.

The scam will frequently cause individuals to lose more money than they think they have been due by the organization. This form of deception is more lucrative for cybercriminals than it has ever been, with Australians having lost $1,488,331 as a result of 563 scam instances in March 2023.

Throughout the 2022 tax season, the ATO issued alerts against a variety of text messages and email frauds. URLs to bogus websites that imitate the ATO website are frequently included in these fraudulent activities, and the victims’ login information is frequently stolen for the purpose of fraudulently obtaining their money.

An ATO representative stated, “The genuine ATO won’t ever send anyone an SMS with a web address for logging in to our online services.”

We also won’t ever request the data of your credit card.

As stated by Sally Tindall, research director at Ratecity.com.au, “There are no restrictions on who fraudsters can pose as. Cyber Intruders always advance in order to go one step before their next victim, not behind!”

“When it pertains to fraud, individuals must always be on guard. Scammers devote a lot of time considering their next move and potential victims,” she further stated.

Due to the fact that many merchants will be providing customers with deals and discounts before tax season, Australians must also be alert to other frauds of this nature.

25% of Australians have been victims of online shopping scams, and CBA has issued a warning to consumers to make sure that the vendor they are buying from is actually who they claim to be.

Before making a purchase, clients are advised by the bank to research businesses online, read reviews and comments, and be aware of outrageously low prices and few transaction alternatives.

Kindly read another article:

Nigerian National from Delhi is Detained by Pune Police for Online Gift Scam

RSAC 2023 Revealed 10 Innovative and Amazing Cybersecurity Tools