Govt. of India To Ban 9 Crypto Exchanges Including Binance For Not Complying Anit-Money Laundering Laws

Govt. of India To Ban 9 Crypto Exchanges Including Binance For Not Complying Anit-Money Laundering Laws

Synopsis:

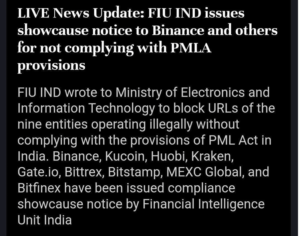

The Financial Intelligence Unit (FIU) has sent a letter to MeitY, requesting the blocking of the URLs of 9 businesses, including Binance. These entities are engaging in illegal operations in India and are not adhering to the laws stated in the PML Act.

The Financial Intelligence Unit (FIU), which is subordinate to the Indian Ministry of Finance, has requested that the Ministry of Electronics and Information Technology (MeitY) disable the URLs of nine offshore cryptocurrency exchanges and issued a show cause notice to them. An action has been initiated in purported non-compliance with the anti-money laundering legislation in India.

These nine cryptocurrency exchanges, including Binance and Kucoin, have been operating unlawfully in India, according to the notice issued by the FIU. Show Cause Notices have been issued to the following nine exchanges: Binance, Kucoin, Huobi, Kraken, Gate.io, Bittrex, Bitstamp, MEXC Global, and Bitfenex.

The show cause notice states, “In accordance with Section 13 of the Prevention of Money Laundering Act, 2002 (PMLA), Financial Intelligence Unit India (FIU IND) has issued compliance Show Cause Notices to the following nine offshore Virtual Digital Assets Service Providers (VDA SPs) as part of its compliance action against the offshore entities.”

Virtual digital asset service providers engaged in operations like virtual digital asset-to-fiat currency exchanges, virtual digital asset transfers, safeguarding or management of virtual digital assets, or supporting control over virtual digital assets are required to register with FIU India as a ‘Reporting Entity.’ These providers may operate within or outside of India. It is incumbent upon them to comply with the prescribed obligations outlined in the Prevention of Money Laundering Act (PMLA) of 2002.

“The regulation imposes on Virtual Digital Asset Service Providers (VDA SPs) reporting, recordkeeping, and other obligations under the PML Act, which additionally involves registration with the FIU India,” the notice continues.

As per the notice issued by FIU, registration for 31 VDA SPs with FIU India is complete at this time. However, despite catering to a substantial portion of Indian users, several offshore entities have managed to evade registration and are therefore exempt from the regulations set forth by the Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) framework.

The FIU India functions as the principal domestic agency entrusted with the responsibility of receiving, processing, analyzing, and disseminating intelligence pertaining to dubious financial transactions to law enforcement organizations and foreign Financial Intelligence Units.

About The Author:

Yogesh Naager is a content marketer who specializes in the cybersecurity and B2B space. Besides writing for the News4Hackers blog, he’s also written for brands including CollegeDunia, Utsav Fashion, and NASSCOM. Naager entered the field of content in an unusual way. He began his career as an insurance sales executive, where he developed an interest in simplifying difficult concepts. He also combines this interest with a love of narrative, which makes him a good writer in the cybersecurity field. In the bottom line, he frequently writes for Craw Security.

READ MORE NEWS HERE