ICICI Bank Account Drained by Scamsters: Cyber Victim’s Shocking Story

ICICI Bank Account Drained by Scamsters: Cyber Victim’s Shocking Story

Cybercriminals have been feigning affiliation with a courier company or law enforcement agency, falsely asserting that they have discovered unlawful activities concerning the victim.

The victim is subsequently threatened with a police inquiry and imprisonment by these cyber criminals. Out of concern for potential legal repercussions, the victim succumbs to the threats of these cybercriminals and executes their commands. However, banks have failed to acknowledge these severe frauds and have granted cybercriminals nodal licenses, which enable them to conduct high-value transactions simultaneously.

The victim Yogesh Sharma, who is based in Gurugram, was recently the subject of the following case:

The incident occurred on Sunday, May 19, 2024, two days after Yogesh returned from Bangalore. At 2 p.m., I received an IVR call from TRAI, which indicated that my phone number would be blocked in the near future. The message read, “To learn the reason and specifics, please press 9.”

The victim’s comprehensive account of the fraud is as follows:

I selected 9 to ascertain the reason. Subsequently, the individual on the other end identified themselves as a TRAI executive (Arjun Gupta) and informed me that an FIR had been filed against my phone number, which is linked to my Aadhar number.

I requested additional information, and they provided me with the name of the individual who filed the FIR for receiving illegal advertising and harassing texts, as well as the FIR number.

Following my request for further information and to refrain from blocking my number, he requested that I retrieve the clarification letter from the relevant Delhi Police station and subsequently transfer the call to Delhi Police.

A woman answered the phone and inquired about the case details. She then verified my information by verifying my Aadhar number. She claimed that my HDFC account, which had been dormant for four years, was involved in money laundering. She claimed that Sandeep Kumar, the head of the HDFC branch, had shared your bank account details with them and that you had also taken a commission to use your account.

Unfortunately, I am unable to recall my bank account number or the internet banking credentials of HDFC. Consequently, I placed my trust in them and believed that they were engaging in unlawful activities with my dormant account.

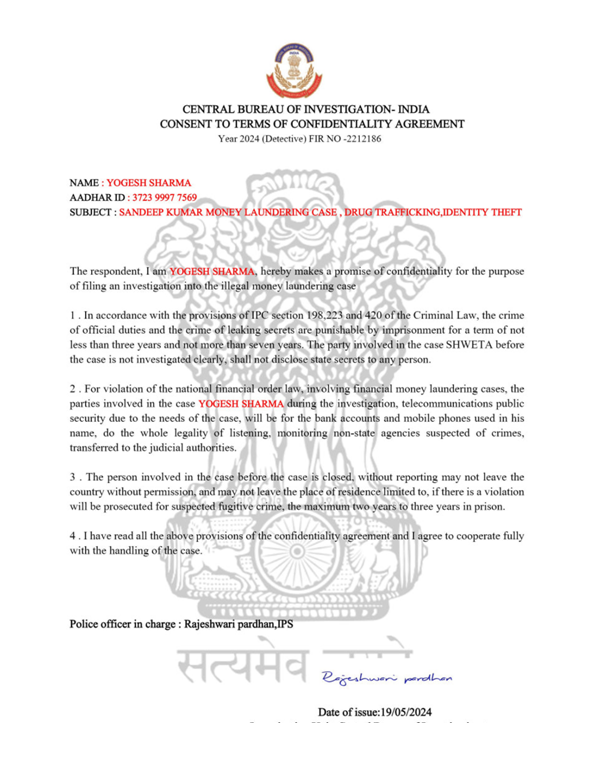

Then, she presented me with two reports: the CBI Report under my name and the Sandeep Kumar fraud case report. She requested that I provide a recorded statement if I was not involved in the case. The court was not operational on Sunday, so the virtual hearing was conducted. Subsequently, I was required to appear in person at the Delhi Court during the working day. So, they requested that I join Skype, where they shared their handle name with Delhi Police, along with an icon. Subsequently, a video call ensued, during which I observed a woman in a police uniform with a formal cabin. She requested all of my personal information and visits.

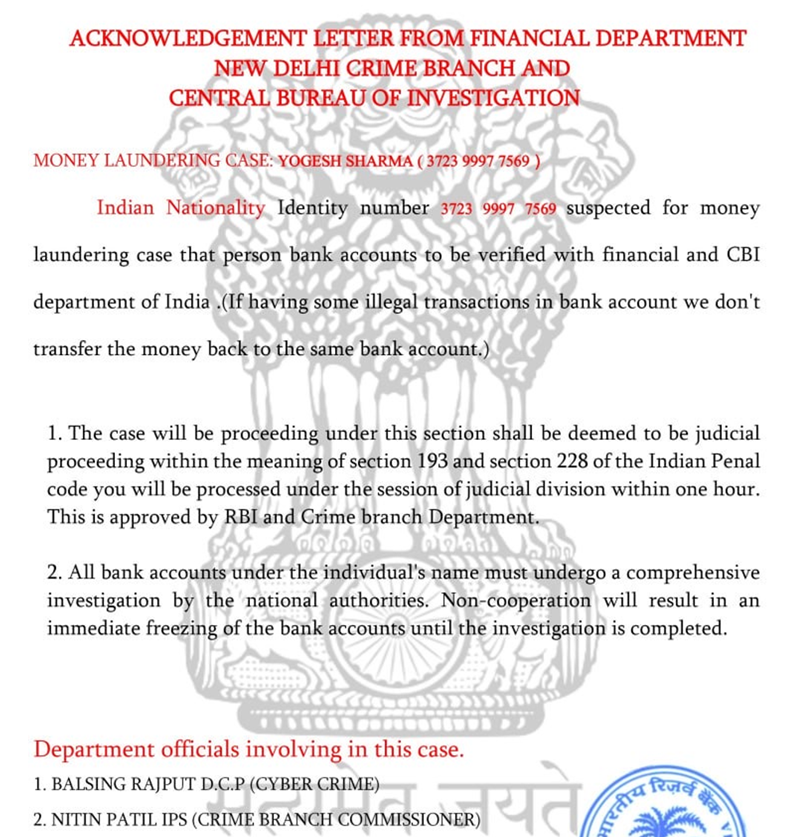

Cybercriminals Distribute Fraudulent Reports:

After a two-hour conversation, she transferred the call to the CBI Director, who was also dressed in a police uniform and had a legitimate name on the table. The CBI Director asked numerous questions and threatened to suspend all of my account details until the court proceedings were completed.

I requested that he refrain from freezing my account details. Subsequently, he requested that I transfer the funds to the Nodal account of the CBI and provide the details of my ICICI bank account.

I transmitted funds in this fraction and was instructed to remain on the call until the hearing process was concluded. However, after 15 minutes, I realized that I had been deceived and terminated the call. I promptly requested that ICICI Customer Support disable my account details and, concurrently, submitted an online complaint to the Cyber Cell.

I have three concerns regarding the bank transfer:

- What is the reason for ICICI opening the current account of these fraudsters? Why did they not verify the company and KYC of the account holders?

- How is it possible for a bank to transmit a substantial sum of money to a new beneficiary within 24 hours?

- I did not receive a confirmation call from ICICI, which is customary for a transfer of ₹50,000.

Certainly, banks are not impervious to fraud, and they are allowing their clients to be deceived comfortably. These high-level cybercrimes should be investigated by regulators, who should also ensure that institutions are held accountable. We trust that this report will prevent others from falling victim to similar cyber frauds.

About The Author:

Yogesh Naager is a content marketer who specializes in the cybersecurity and B2B space. Besides writing for the News4Hackers blog, he’s also written for brands including CollegeDunia, Utsav Fashion, and NASSCOM. Naager entered the field of content in an unusual way. He began his career as an insurance sales executive, where he developed an interest in simplifying difficult concepts. He also combines this interest with a love of narrative, which makes him a good writer in the cybersecurity field. In the bottom line, he frequently writes for Craw Security.

READ MORE ARTICLE HERE